Select Valuation Methods

Select Income Approach

Select Calculate Discount Rate

![]()

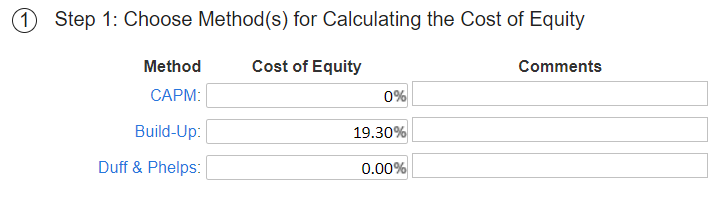

Select Step 1: Method(s) for Calculating Cost of Equity

Choose any of the following: CAPM, Build-Up or Duff & Phelps

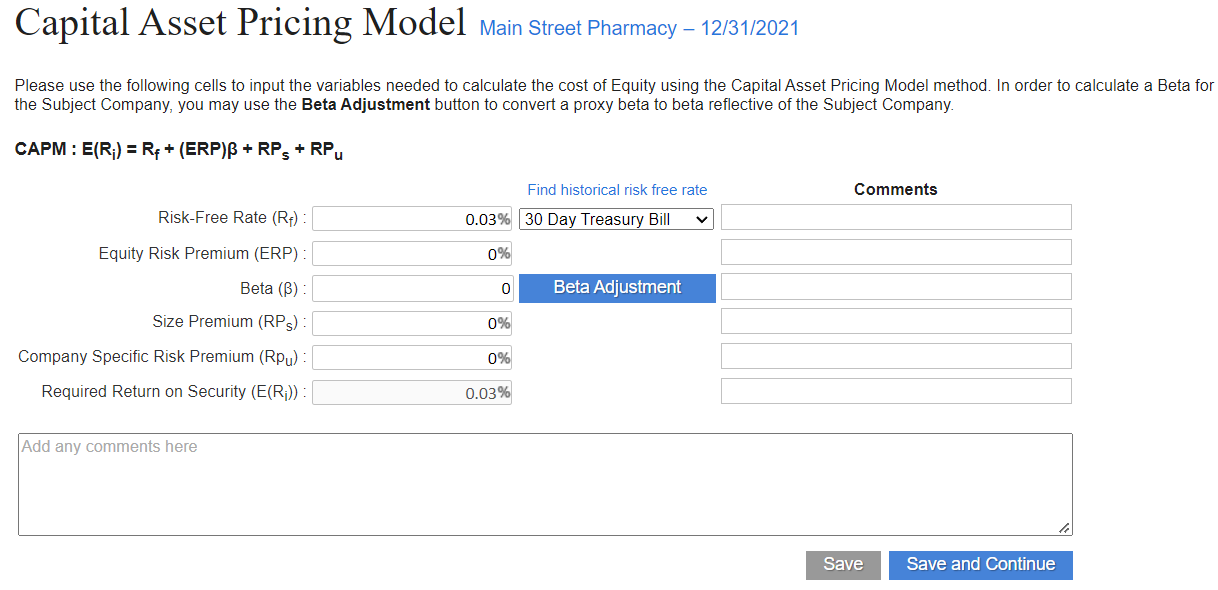

Option 1 – CAPM – Capital Asset Pricing Model

Select Risk-Free Rate

SVS provides updated 10- and 20-year Treasury Bond rates, in addition to 30-day Treasury Bill.

Enter values for Equity Risk Premium, Beta, Size Premium, Company Specific Risk Premium, and Required Return on Security

Note - line-specific and general commentary boxes are available and pull into final report.

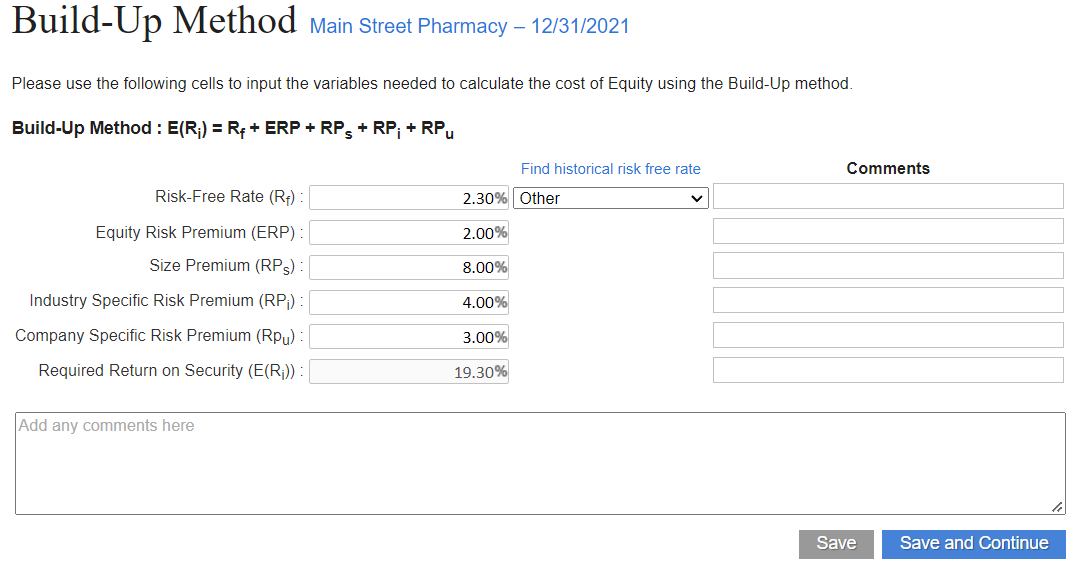

Option 2 – Build-Up Method

Select Risk-Free Rate

SVS provides updated 10- and 20-year Treasury Bond rates, in addition to 30-day Treasury Bill.

Enter values for Equity Risk Premium, Size Premium, Industry Specific Risk Premium, Company Specific Risk Premium, and Required Return on Security

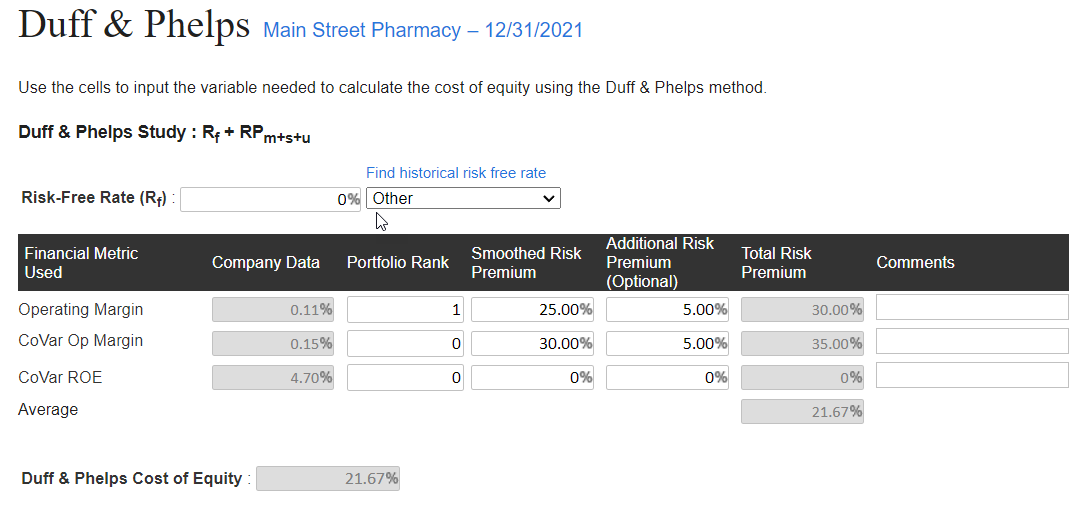

Option 3 – Duff & Phelps

***Usage of the Duff & Phelps option requires a subscription to their service and is not included in the SVS license***

Select Risk-Free Rate

SVS provides updated 10- and 20-year Treasury Bond rates, in addition to 30-day Treasury Bill.

Enter Portfolio Rank

Enter Smoothed Risk Premium

Enter optional Additional Risk Premium

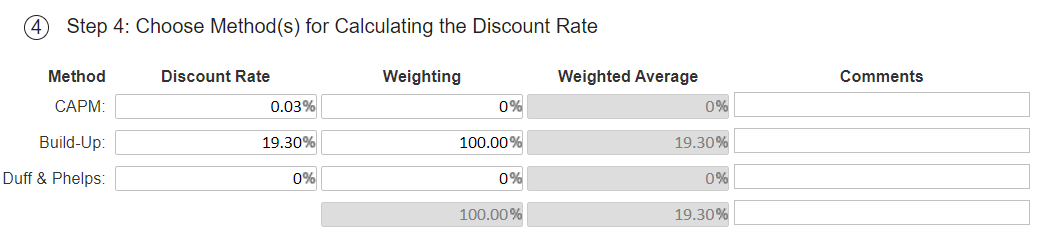

Weight your Cost of Equity calculations in Step 4: Choose Method(s) for Calculating the Discount Rate

Select Save or Finish